I had a discussion with another parent recently regarding teaching kids about money and something she said has been on my mind. We were talking about what is the “going rate” to pay babysitters these days and she said, “My problem is just finding a babysitter. Too many teenagers these days could care less because they just get the money they need from their parents.” This statement made me sad. I too have been surprised lately with the lacking desire in teens to earn money. I was always doing whatever I could to earn money as a kid, and had a job of some sort from the age of 12 all through college. I've done more babysitting than I could ever count, I've done the fast food thing, I've worked in health care, I've worked in retail, custodial, and the list goes on and on. Although a lot of it was hard work, I have fond memories at almost all of the jobs I have had; they are a part of my history.

Granted, I had more financial responsibility starting at the age of 12 than I would wish on any teenager (bought my own clothing and paid my own school fees starting in junior high), but I'm so grateful for the experiences that I had and what they taught me. I have a teacher for a husband and our income is pretty limited, but that doesn't limit me from having some things that I want. For example, I hated our teeny couch that we got when we were first married. It barely fit the two of us and company never had a place to sit when they came over. I really, really wanted a brand new beautiful sectional that I saw at a store. Did our income allow for it? No. But my experience as a teen taught me that if I want something bad enough I can work for it. So I started selling my belongings and saving up. And believe it or not I purchased that $1000 couch after only a few months (I'm sitting on it right now and I still love it). The same thing occurred with our Blendtec blender. My husband would never agree that $400 of our paycheck should go to a high-tech blender, but it was important to me (I'm a green smoothie fan) so I found a way to make money and purchase one.

Enough about my history, this is about the kids. I've been brainstorming ways to teach children to manage and respect money, and these are my thoughts. I'd love to hear yours as well!

Teaching Children to Manage and Respect Money

Allowance? I agree as well as disagree with certain principles in regards to an allowance. I believe that children should understand that they are part of something larger than themselves: a family; and that as a family member you have a part to play and that means a little hard work here and there. It is my personal opinion that chores are done without expectation of “getting” something in return, but that anything “extra” could be used for earning opportunities, but I also believe that allowances are a great way of teaching kids about money. I liked how my best friend's family did it growing up. They had their personal chores that they were expected to accomplish, and then on the backside of one of the cabinet doors was a list of various extra chores as well as how much they could earn doing them. I remember earning some money myself by swatting flies when I was at their house (Ha, I believe each fly was worth 5 or 10 cents)!

For kids 5 yrs and above: Use real money for allowance

Under 5: Get fake coins for them to earn for behavior and various tasks, and let them redeem them at the “treasure box.” Just make sure the coins are big enough not to be a choking hazard!

Teach your children that sometimes you must give up something good for something greater. Teaching kids about money also means teaching them that sometimes things must be earned. Planning a family trip to Disneyland? Rather than just taking them, have a valuable learning experience along the way. Teach them ways that you can save as a family to allow more money to go towards the trip. Maybe they can give up certain luxuries from the grocery store for a few months (No Oreos? what?). How about washing the car by hand as a family rather than going to the express wash? Even if your family is financially blessed, your children will be greatly blessed in the future if they learn these valuable lessons.

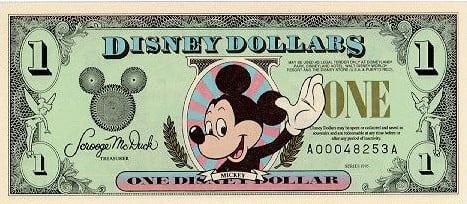

Don't give into begging or you are creating a repeat-issue. If your children automatically know they need to earn the things that they want, they will beg less often. Another couple that my husband and I are good friends with uses this principle when they go to Disneyland. They noticed the first time they went that their children begged all day for souvenir after souvenir. The next year, they planned ahead of time. For several months before the trip they gave their children opportunities to earn “Disney Bucks,” and the children understood that the only souvenirs they could buy must be purchased with Disney Bucks. When they left on the trip their Disney Bucks were turned in and replaced with real dollars. These parents were amazed that their children no longer had interest in every little thing; rather, they wanted to wait and make sure their Disney Bucks were spent on their most favorite items. They became a lot more conscious of what they thought they “wanted.” We think it's a great idea and plan on doing it for our Disney trips too. Since then I have found these printable “Disney Bucks,” that are super cute in case you don't want to make your own.

Let your children make “bad” financial decisions. Teaching kids about money also involves letting them make mistakes. Don't like the toy they want to buy? Know without a doubt that it will break within 2 days? Let them buy it. That doesn't mean you can counsel and give advice, but it's better for your children to make poor financial decisions while they are young and learn from them, then to start the learning when they are adults. Make sure to have follow-up discussions after certain purchases so that your children can start to recognize bad, good and better ways to spend their money.

Let them learn with you. Don't be afraid to let your children know how you handle the bills, or prioritize your shopping list, or calculate the tip at the restaurant. Once again, the earlier they learn the better.

Let them explore money earning opportunities. Dreading the lemonade stand? Would rather just give them some money? Don't do it. Those moments are valuable. Let your children do the lemonade stands and the bake sales and be a part of their learning process by doing it with them! I remember as a kid sitting at the corner with my lemonade stand and counting in my head how many cups of lemonade I needed to sale to make $10. When sales didn't approach my goal, I grabbed my 10 gallon dispenser and started going door to door! Granted, my mother had no idea which is why it's a good idea to be part of the process so that your kids make safe decisions. Because of the many lemonade stands I attempted as a kid I have a rule as an adult that as long as I have change in my wallet I will stop at EVERY lemonade stand that I pass. It brings back old memories and just feels good to support the children with drive!

Yard Sales and Classifieds. Yard sales are another drudgery among parents, but they are great learning experiences for kids especially if you let them sell some of their own items. I have a hard time bartering for a lower price when I know that a kid is selling the item personally. I also love it when I get onto Craigslist and see listings for a toy with the description, “my child is exploring ways to earn money and wants to sell some of her toys.” Beautiful!

I will add to this list later, but these are just some of the ideas I have been thinking about. What do you do to teach your children about money? I'd love to hear!

The image featured at the top of this post is ©The Walt Disney Company – License / Original